Every month, your salary gets credited, and along with it comes a seemingly complex document your salary slip. Most people glance at it briefly, some don’t look at it at all, and very few actually understand it.

But here’s the truth: a salary slip isn’t just a piece of HR formality it’s a powerful document that provides deep insight into your earnings, deductions, taxes, and employment benefits. Understanding it helps you take control of your finances, claim tax benefits, and even negotiate better during job switches.

And if you’re an HR professional or business owner, you know that generating error-free salary slips and managing payroll for multiple employees is no small task. This is where a modern HRMS (Human Resource Management System) comes in, automating complex processes and ensuring 100% compliance.

In this guide, we’ll break down what a salary slip is, what each component means, how it affects you, and how platforms like Runtime HRMS can help you to run one-click payroll and stay updated with latest compliance.

What is a Salary Slip?

A salary slip, or payslip, is a monthly document issued by an employer that details an employee’s earnings, deductions, and net salary. It is not just a financial record it is also a legal document and proof of your income.

Why salary slip matters:

- Acts as proof of employment and income

- Essential for loans, visas, and credit cards

- Crucial for filing income tax returns

- Useful in job interviews and salary negotiations

Key Components of a Salary Slip

Every salary slips typically have three main sections:

1. Earnings

2. Deductions

3. Net Salary (Take-Home Pay)

1. Earnings (Income Section)

- Basic Salary

- HRA

- DA

- Conveyance Allowance

- Medical Allowance

- Special Allowance

- Bonus/Incentives

2. Deductions

- Provident Fund (PF)

- Tax Deducted at Source (TDS)

- Professional Tax (PT)

- Employee State Insurance (ESI)

- Loan EMIs/Advances

3. Net Salary

Net Salary = Gross Earnings – Total Deductions

This is the amount that hits your bank account every month.

Read this documentation to know more about "Salary Components" in Runtime HRMS.

CTC vs Gross vs Net Salary

CTC: Cost to Company — total expense incurred by the employer

Gross Salary: Earnings before deductions

Net Salary: Final in-hand pay after all deductions

Read this article to know more about CTC - What is CTC in your salary slip?

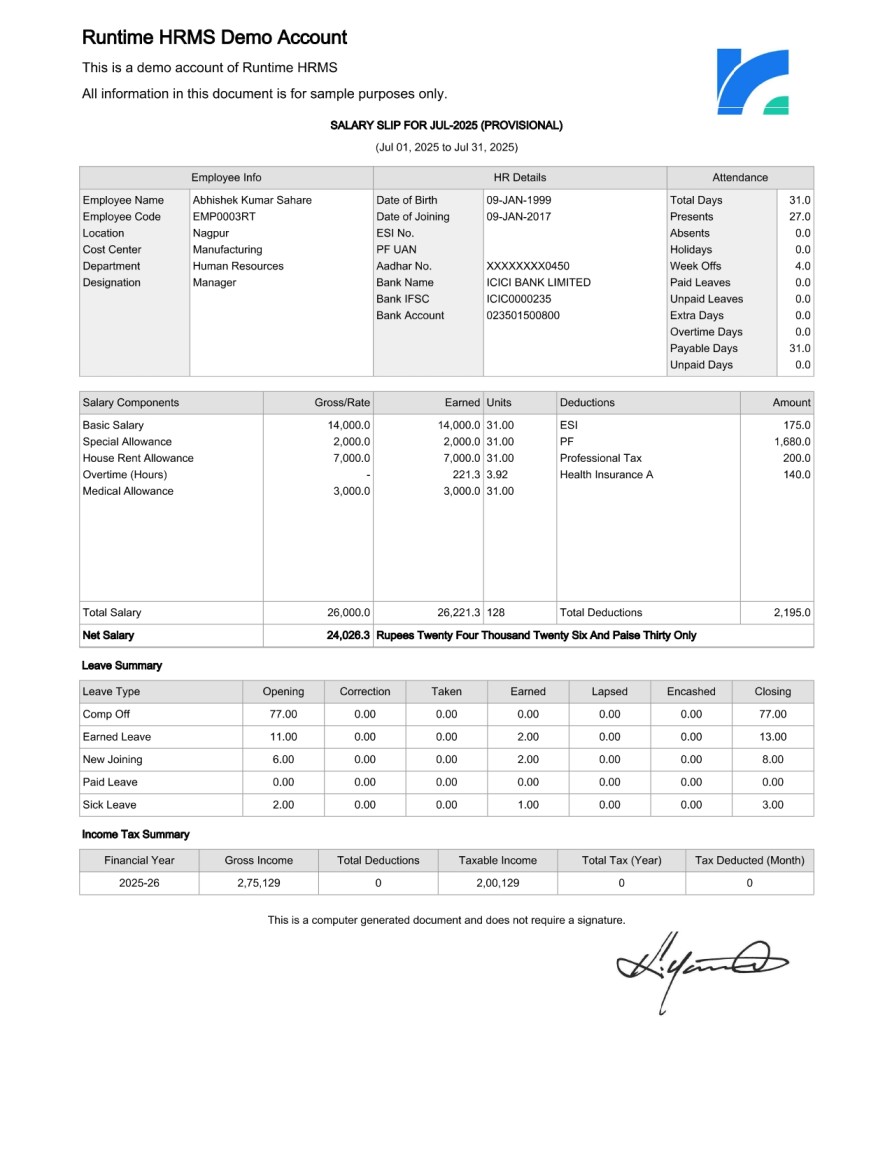

Sample Salary Slip

Why You Should Check Your Salary Slip Regularly

- To verify salary calculations

- To ensure correct deductions

- To claim tax exemptions properly

- To stay compliant for tax and loan purposes

Tax Benefits Hidden in Your Payslip

- HRA Exemption

- LTA

- Meal/Transport Vouchers

- Phone & Internet Bill Reimbursements

- NPS Contributions

Common Mistakes to Avoid in Salary Slip

- Ignoring PF and TDS calculations

- Confusing gross salary with net pay

- Not saving or reviewing payslips

- Missing tax-saving opportunities

- Overlooking ESIC/PT applicability

How HRMS Systems Simplify Payroll & Salary Slip Generation

For businesses, managing payroll can be complex. HRMS platforms automate everything from attendance to payslips.

1. Automates Salary Calculations

Calculates salary components and deductions accurately, ensuring timely payments.

Read this help document to know more about processing payroll.

2. Integrated with Attendance & Leaves

Syncs with biometric systems or apps to calculate LOPs and working days automatically.

3. One-Click Salary Slip Generation

Auto-generates compliant, professional salary slips for all employees.

4. Tax Compliance Made Easy

Calculates TDS, tracks declarations, and generates tax documents like Form 16.

5. Custom Salary Structures

Supports hourly, monthly, and project-based payments with multiple templates.

Read this documentation to know more about "Salary Structures" in Runtime HRMS.

Lets employees download payslips, submit tax proofs, and raise payroll queries.

Why Choose Runtime HRMS for Payroll & Payslips?

Runtime HRMS is a smart, affordable solution with cloud access, payroll automation, statutory compliance, and mobile-ready ESS portal.

Salary Slip FAQs

Q1. Can my employer deny me a salary slip?

A: No, it's legally required.

Q2. What if my payslip has errors?

A: Contact your HR for corrections.

Q3. Can salary slips be generated without an HRMS?

A: Yes, but HRMS reduces errors.

Q4. How long should I keep salary slips?

A: Indefinitely.

Q5. Do bonuses appear on payslips?

A: Yes, in the payout month.

Best Practices for Employees & Employers related to Salary Slips

This is what employees can do:

- Review monthly salary slips

- Keep records of all your salary slips

- Reconcile with offer letters

- Track tax according to your income

This is what every employer must do:

- Use HRMS software like Runtime HRMS to run smooth payroll

- Provide self-service access to your workforce opt for Employee Payroll Management System

- Ensure compliance by using the best and affordable HR and Payroll Software.

- Avoid manual errors and spreadsheets for complex payroll related tasks

Conclusion

Salary slips are essential tools for financial planning and compliance. Employees should understand them, and employers should automate them. With Runtime HRMS, payroll and payslip generation become simple, fast, and error-free.

More in HR Technology

-

Outsource Payroll vs In-House Payroll for Indian Businesses (2026 Guide)

Dec 12, 2025

-

Top 10 Payroll Software in India for Small Businesses (2026 Guide)

Nov 24, 2025

-

30 Common HR Manager Interview Questions and Answers

Nov 07, 2025

-

Loss of Pay (LOP) in HR: Meaning, Calculation & Best Practices | Runtime HRMS

Oct 23, 2025

-

From Annual Reviews to Continuous Feedback: The Future of Performance Management

Sep 17, 2025

-

5 HRMS Features That Could Make Employee Onboarding Easy

Sep 12, 2025

-

Why Robust BGV Matters- Especially for C-Suite Hiring

Aug 21, 2025

-

What are the best methods of recruitment?

Aug 18, 2025

-

9 HRMS Functionalities That Enhance Company Culture

Jul 30, 2025

-

Why Every Growing Business Needs an HRMS

Jul 16, 2025

-

The Modern Guide to Effective Employee Management for HR Professional

Jul 11, 2025

-

Experience Letters in Human Resources: Format, Importance & Automation

Jun 20, 2025

-

The Beginner’s Guide to HRMS Payroll

May 29, 2025

-

30 HR Terminologies Every HR Should Know

May 22, 2025

-

OKR vs. SMART Goals: How to Set Right Goals?

May 09, 2025

-

How to Give Constructive Feedback During Appraisals

Apr 28, 2025

-

Smart Ways to Track Employee Time and Attendance

Apr 18, 2025

-

Excel vs Payroll Software: Which One is Better for Your Business?

Mar 19, 2025

-

Top 7 Payroll Processing Challenges

Feb 27, 2025

-

How to Choose the Best Employee Management Software for Your Business

Feb 16, 2025